Giuseppe Moscarini Delivers Plenary Talk at the 2022 Society for Economic Dynamics

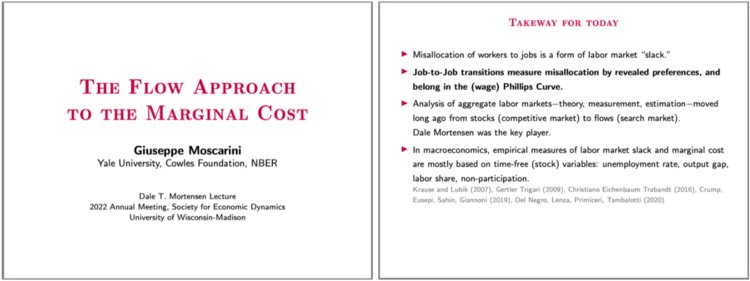

The Society for Economic Dynamics’ (SED) Annual Meetings bring together leading researchers for talks and lectures on the most important new ideas in macroeconomics and related fields. At this year’s meeting, Yale Economist Giuseppe Moscarini delivered the Dale T. Mortensen Plenary Lecture, titled “The Flow Approach to Marginal Cost.” He presented recent research on the interplay between job-to-job quits and wages. While individual workers tend to gain from changing jobs, high aggregate quits in tight labor markets predict lower wages, and ultimately inflation.

Professor Moscarini’s talk examined specific measures of how well workers are matched with their jobs. He delved into worker misallocation by looking at reasons that an employee might apply for a new job (e.g., because they are unhappy), or accept an offer (e.g., they receive a higher salary offer, and/or it’s a better match).

An important component of this work is the dual function of outside job offers: workers can either accept these or potentially present them to their current employers in order to raise their current salary. These two scenarios are vastly different in terms of their implications for the labor market. If someone uses an outside offer to raise their salary, they do so without increasing their productivity, putting a positive and inflationary pressure on wages. Yet if someone receives and accepts the outside offer, this may indicate that their previous job was a bad match. This propensity to switch from job to job rather than negotiate for a higher salary can then serve as a proxy measure of how many people have inefficient or or poorly allocated jobs, providing a glimpse into slack in the labor market above and beyond the traditional unemployment measure.

To study these dynamics empirically, Moscarini and co-authors use data from the monthly Current Population Survey (CPS) to create a timeseries that measures the employer to employer transition rate (i.e., how often workers are accepting outside offers). This publicly available dataset tracks employer-employer transition rate, which allows researchers to better understand trends in the labor market. Moscarini utilizes the series to create the acceptance ratio, a novel macroeconomic measurement defined as the rate at which employed people switch jobs divided by the rate at which unemployed people find jobs.

Moscarini’s key finding from the talk is that this ratio has a negative causal relationship with wage growth (i.e., it moderates future inflation, independent of the unemployment rate), both in U.S. data and in an estimated macroeconomic model. The essential intuition is that outside offers can have two separate, mutually exclusive impacts: prompting an employer-employer transition or increasing wages at the same job. When these outside offers are prompting more transitions, we know that fewer people who receive outside offers have ‘good jobs.’ Seeking and accepting an outside offer is a proxy indicator for labor mismatch, and a signal of a less productive labor market. The higher the acceptance rate, the more poorly allocated workers, the more the reallocation, anti-inflationary effect dominates.

The presentation is part of a body of labor market research by Moscarini and co-authors, including his recent paper with Fabien Postel-Vinay (University College London), titled ‘The Job Ladder: Inflation vs. Reallocation.” The full slides for the talk are available here.

—

Founded in 1990, the Society for Economic Dynamics (SED) represents a grassroots movement among economists to create a modern network of top researchers and a doorway for young scholars to join the discussion. The Dale T. Mortensen Lecture is named in honor of the Nobel laureate and co-founder of SEC, who pioneered the modern understanding of labor markets by demonstrating the importance of labor flows and frictions—the rate at which workers change employment status—in determining important macroeconomic outcomes.