Eduardo Dávila and Ryota Iijima Named Sloan Fellows for Early-Career Excellence

The Alfred P. Sloan Foundation has named Yale economists Eduardo Dávila and Ryota Iijima recipients of the 2024 Sloan Research Fellowship, an honor that recognizes outstanding early-career scientists and scholars.

According to the Sloan Foundation, Fellows “represent the most promising scientific researchers working today. Their achievements and potential place them among the next generation of scientific leaders in the U.S. and Canada. Winners receive $75,000, which may be spent over a two-year term on any expense supportive of their research.”

They are among 5 Yale faculty members and 126 researchers total from the U.S. and Canada selected to receive a fellowship in 2024.

Dávila is an Assistant Professor of Economics, and a Faculty Research Fellow at the NBER. He joined the Yale faculty in 2018, and his research focuses on how financial and macroeconomic policies affect individuals.

"I'm thrilled to see my research program recognized with a Sloan Research Fellowship and thankful for having wonderful mentors, colleagues, and collaborators who have supported my work,” Dávila said. “I plan to leverage this generous award to advance the study of the efficiency and optimal design of macro-financial policies."

Iijima is an Associate Professor of Economics. He joined the Yale faculty in 2017, and his research interests include microeconomic theory, decision theory, information economics, and networks.

“I am profoundly grateful and excited to be recognized with this fellowship,” Iijima said. “I would like to thank my collaborators, colleagues, and mentors at various stages, whose insights and support have been crucial to my development as a researcher.”

In the interviews below, Dávila and Iijima discuss their research interests, latest projects, and what drew them to economics.

Eduardo Dávila

What’s the current focus of your research?

What’s the current focus of your research?

I study whether macro-financial policies are desirable and how to improve them. My work lies at the intersection of financial economics, macroeconomics, and public economics, and has a strong normative focus. My research focuses on understanding the welfare of economic actors, with the ultimate objective of understanding how policies or events make individuals better or worse off.

In recent work, I have studied how to optimally set monetary policy in environments with rich individual heterogeneity and the optimal design of regulation when regulators have access to a limited set of policy instruments. I have also recently explored how to compute the welfare gains associated with removing arbitrage violations in financial markets.

Department of Economics 2023 Annual Magazine

Welfare and the Macroeconomy

Welfare and the Macroeconomy

Dávila’s research was recently featured in the Department’s 2023 Annual Magazine.

What project are you most excited about right now?

I am working on a project that introduces a new framework for intergenerational welfare comparisons. This line of research has the potential to inform the design of social security and climate policies, whose consequences impact multiple generations. This paper is part of a broader agenda that seeks to determine the ultimate origins of welfare gains and losses in realistic economies with rich heterogeneity in both households and firms.

What led you to Economics? To your current research trajectory?

As unusual as it may sound, I've wanted to be an economist since I was very young. I love how economics uses precise mathematical reasoning to explore complex social issues. Early on, as an undergraduate student, I had direct exposure to the area of project evaluation, which answers practical questions of the form: is it desirable for society to build a bridge or a highway? I was fascinated by how it is possible to provide clear, well-reasoned answers to these important questions. I also greatly enjoyed an undergraduate course on Financial Economics (very similar to the one I currently teach at Yale!). I started my PhD in 2008, during the global financial crisis, which made clear to me that there was scope to make normative contributions to macroeconomics and finance.

Ryota Iijima

What’s the current focus of your research?

What’s the current focus of your research?

I work on theoretical models of how individuals learn from information and make decisions, in particular in complex environments. The traditional modeling approach in economics is that people correctly understand their environment and the uncertainty they face and are able to make optimal decisions based on this. Departing from this approach, several of my papers provide tools to analyze people’s learning and decisions when they misperceive some aspects of their environment and/or have ambiguous beliefs about the uncertainty they face. Some of my other papers explore a different direction: Can some simple learning/decision rules that people commonly use be viewed as approximately optimal?

What project are you most excited about right now?

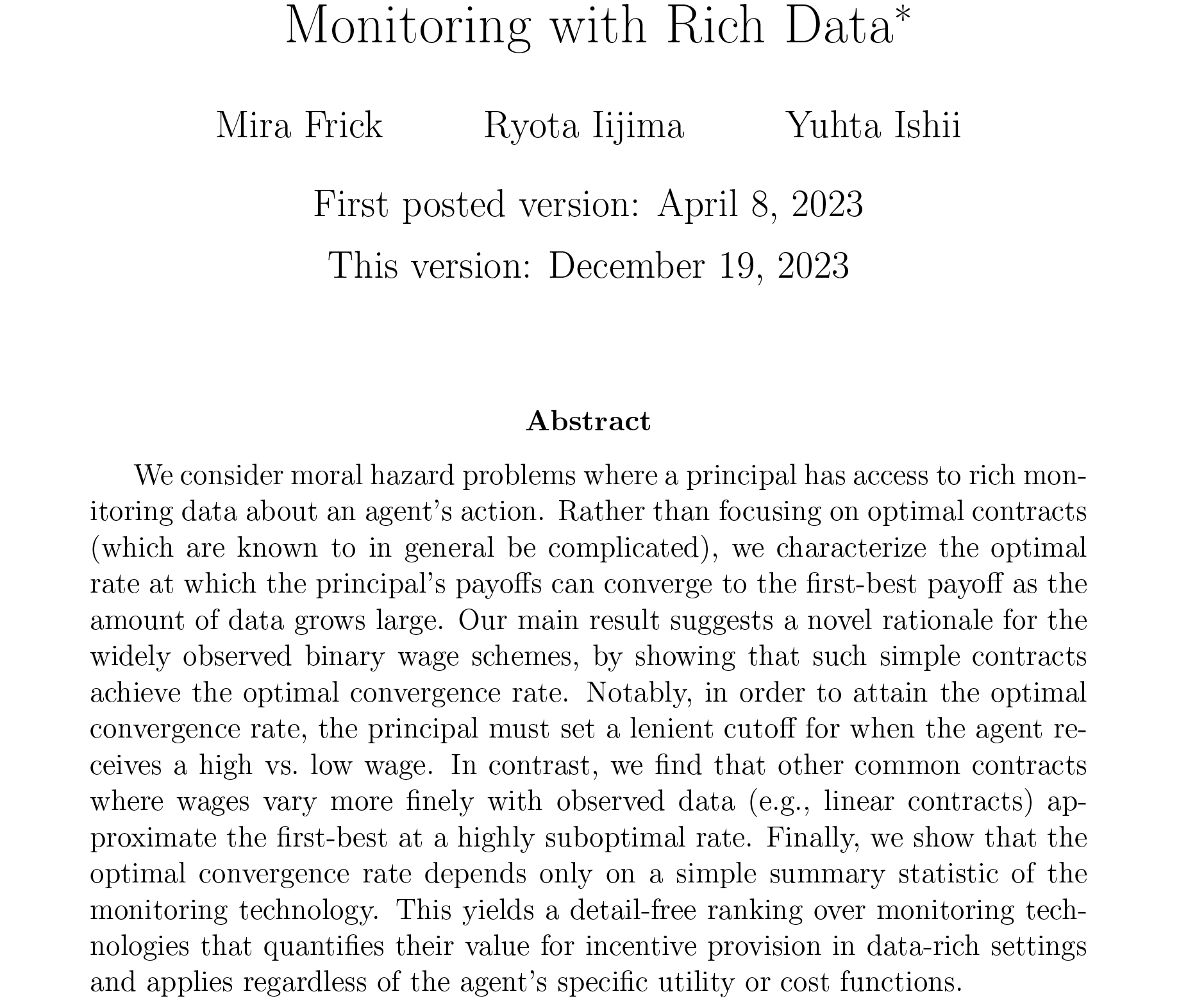

Recent technological advances give agents access to rich data in many economic environments. In a series of projects with my co-authors Mira Frick (Yale) and Yuhta Ishii (Penn State), we explore whether there are simple policies that perform well at exploiting such rich data. For example, consider a firm that sells multiple different goods to a consumer whose valuations of these goods are unknown. It is well-known that the firm’s optimal selling mechanism can be very complicated and does not resemble pricing schemes observed in reality. However, in an ongoing project, we show that when the seller has access to rich data about the consumer’s preferences, a simple and widely observed mechanism—selling the goods as a bundle—performs essentially as well as the optimal mechanism, whereas other simple mechanisms do not.

In a related paper, we study an employer who designs a wage contract to incentivize her employees to exert effort. Again, optimal contracts can in general be complicated and unrealistic. However, we show that when the employer has access to precise monitoring data about workers’ effort, a simple class of contracts—single-bonus schemes—is approximately optimal, whereas other common contracts (e.g., linear contracts) can be highly suboptimal.

Iijima's Research

Iijima's Research

Monitoring with Rich Data

by Mira Frick, Ryota Iijima and Yuhta Ishii

December 2023

What led you to Economics?

While economics encompasses a diverse range of topics and approaches, it is disciplined by formal reasoning, which gives it clarity and elegance. As an undergraduate at the University of Tokyo, I was initially interested in how social norms or institutions evolve over time. From there, I was drawn to evolutionary approaches in game theory, which analyze dynamic interactions of people who follow simple learning or decision rules. Some of my current research is still in this spirit.

Sloan Research Fellowships are awarded in eight scientific and technical fields: computer science, neuroscience, physics, economics, chemistry, computational and evolutionary molecular biology, mathematics, and Earth system science.

Other scientists nominate candidates for the fellowships. Winners are selected by an independent panel of senior scholars on the basis of the candidates’ research accomplishments, creativity, and potential to become leaders in their field.

Since the first Sloan fellowships were awarded in 1955, 139 faculty from Yale have received a fellowship, including this year’s winners.